- ClimateOS Africa.

- Posts

- Issue #12. Africa's 50-Most Funded Climate-Tech Startups. Part 2. (11-20).

Issue #12. Africa's 50-Most Funded Climate-Tech Startups. Part 2. (11-20).

African climate-tech startups have raised $3bn from 2019-2024. We profiled the 50-Most Funded Climate-tech Startups.

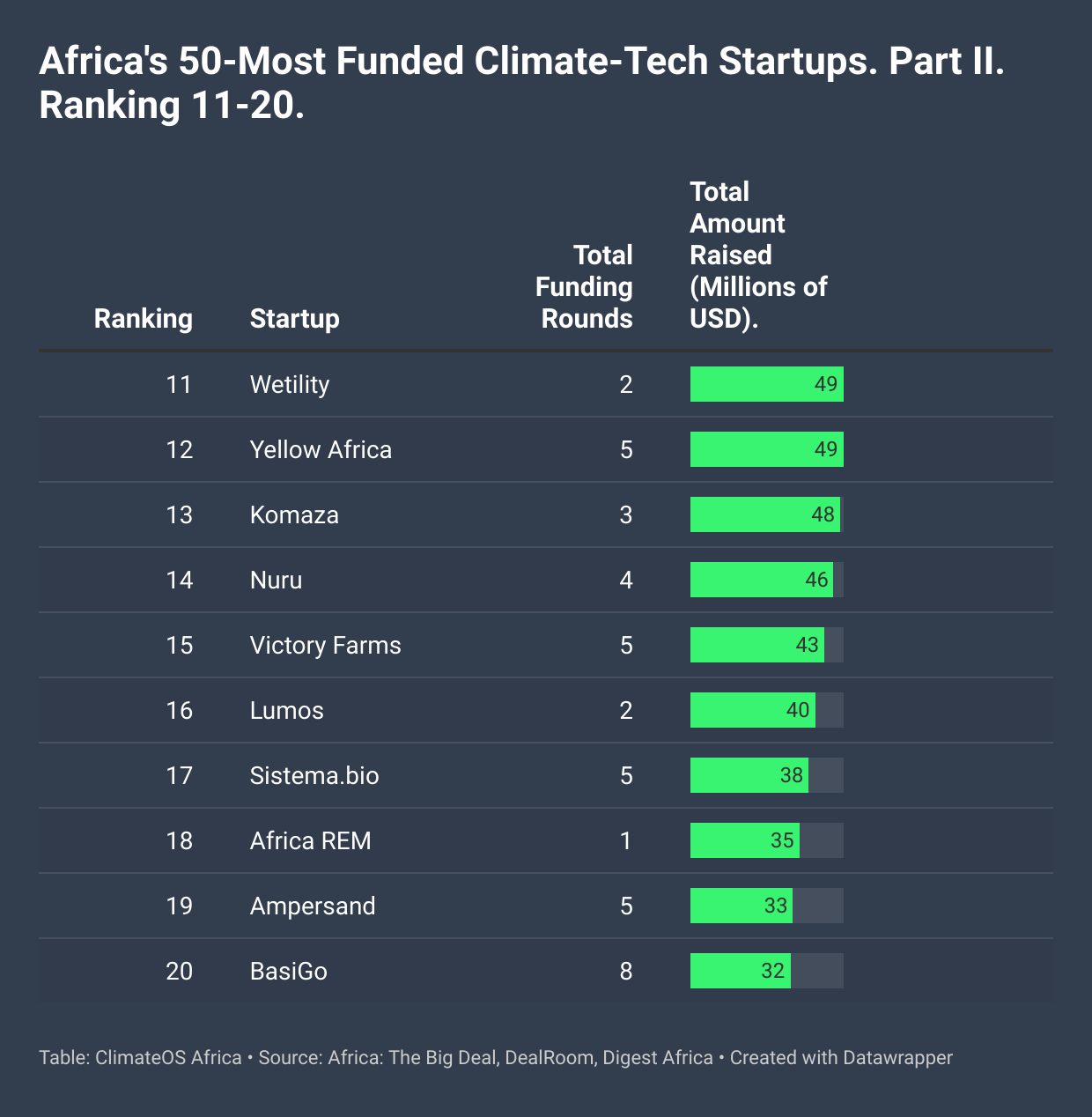

Welcome to part II of Africa’s Most Funded Climate-tech Startups. If you are reading this, and didn’t read part 1, you can find it here to get proper context of today’s issue. In Part II, we are profiling startups ranked 11 - 20 on our list. Here is a summary of the startups that we are profiling today.

11. Wetility

Country: South Africa

Amount Raised: USD 49M

Funding Rounds: 2

Sector: Solar

Wetility

Wetility, founded in September 2019 by Vincent Maposa and a team of entrepreneurs and financial experts, is a South African solar energy solutions company addressing the country’s energy crisis.

Based in Gauteng, Wetility offers hybrid solar systems under a subscription and lease model, enabling homes and small businesses to generate, store, and monitor clean energy.

Its flagship product, the Wetility Pace Box, combines Tier 1 hybrid inverters with lithium-ion batteries, providing backup power during outages. Wetility’s innovative approach includes proprietary software like the We-X App for remote energy management and tools like the Rapid Calculator for seamless customer onboarding.

With a vision to serve over 350 million Southern Africans, Wetility aims to alleviate energy poverty while fostering collaboration with utility companies.

Wetility has attracted notable investor interest through its differentiated business model and strong branding. The company has partnered with leading banks for financing solutions and Tier 1 component suppliers for high-quality products.

In 2022, Wetility received support from Multichoice’s Innovation Fund to scale operations. Its growth strategy includes expanding nationwide in South Africa and reaching one million homes within ten years, inspired by US solar company Sunrun.

Wetility’s focus on affordability and reliability has positioned it as a key player in the distributed solar PV market for residential and SME sectors in Africa.

12. Yellow Africa

Country: Malawi

Amount Raised: USD 49M

Funding Rounds: 5

Sector: Solar Yellow Africa, founded in 2018 by Mike Heyink in Malawi, is a solar asset financing company that provides affordable off-grid solar systems and smartphones to underserved communities across Africa.

By leveraging its proprietary software platform, "Ofeefee," Yellow digitizes operations, enabling a distributed network of over 1,100 sales agents to serve rural households efficiently.

The company’s innovative approach combines behavioral economics and real-time digital incentives to decentralize credit decisions, achieving high repayment rates among unbanked populations.

Operating in Malawi, Madagascar, Rwanda, Uganda, and Zambia, Yellow has brought electricity or internet access to over 400,000 households, tripling rural electrification rates in Malawi alone. Its most popular product is a small solar home system comprising a panel, battery, lights, phone charger, and radio.

Yellow has raised $49 million in funding through debt and equity rounds. Notable deals include a $14 million Series B in June 2023 led by Convergence Partners and the Energy Entrepreneurs Growth Fund managed by Triple Jump.

Earlier rounds included a $3.3 million Series A investment in 2021. The funds have been used to expand geographically, enhance product offerings like smartphone financing, and strengthen operational capabilities.

Yellow’s profitability and compound annual growth rate of 265% over four years reflect its transformative impact on energy access and connectivity in Africa. With plans to deepen expertise in existing product categories and introduce mobile financial services, Yellow continues to bridge the energy gap for millions across the continent.

13. Komaza

Country: Kenya

Amount Raised: USD 48M

Funding Rounds: 3

Sector: Agritech

Komaza, founded in 2006 by Tevis Howard, is a Kenyan-based forestry company revolutionizing timber production through its innovative "micro-forestry" model.

The company partners with smallholder farmers to plant and manage sustainable tree farms on underutilized land, providing seedlings, technical support, and access to markets. Farmers supply land and labor while Komaza handles harvesting, processing, and sales.

To date, Komaza has planted over 7 million trees with 22,000 farmers, making it Kenya’s largest industrial tree planter. With headquarters in Kilifi, Komaza aims to address Africa’s $30 billion wood supply deficit sustainably by scaling operations to plant 1 billion trees with 1 million farmers across 10+ countries by 2030. The company has received recognition for its environmental and social impact, including awards from Forbes and Ashoka.

Komaza has raised significant funding to expand its operations. In July 2022, it secured $28 million in a Series B equity round co-led by AXA Investment Managers (AXA Impact Fund) and Dutch development bank FMO, with participation from Mirova’s Land Degradation Neutrality Fund and Novastar Ventures.

This followed a $9.9 million Series A round led by Novastar Ventures in 2017. Earlier investments included a $500,000 convertible note from Conservation International Ventures to strengthen operational efficiency.

These funds have supported Komaza’s expansion into East Africa and upgrades to its wood processing facilities. By merging financial sustainability with environmental conservation, Komaza continues to transform forestry practices while empowering smallholder farmers across Africa

14. Nuru

Country: Democratic Republic of Congo (DRC)

Amount Raised: USD 46M

Funding Rounds: 4

Sector: Solar

Nuru

Nuru, founded by Jonathan Shaw in 2015, is a climate-tech company based in the Democratic Republic of Congo (DRC) that specializes in utility-scale solar metrogrids.

These metrogrids provide reliable, renewable, and low-carbon energy to urban communities in the DRC, where less than 20% of the population has access to electricity. Nuru’s innovative approach integrates cutting-edge technology to deliver 24/7 power to households, businesses, and industries, fostering economic growth and climate resilience.

The company successfully implemented its first pilot project in Goma, installing a 1.3 MWp capacity in 2020. Nuru plans to scale its operations across cities like Kindu, Bunia, and Beni, with the Bunia metrogrid set to become the largest off-grid solar hybrid system in sub-Saharan Africa.

Nuru has raised significant funding to support its expansion. In July 2023, it secured $40 million in Series B equity funding from investors such as IFC, Proparco, GEAPP, REPP, Voltalia, and the Schmidt Family Foundation. Earlier rounds included a Series A led by E3 Capital and EDFI ElectriFI in 2018.

The funds are being used to expand Nuru’s metrogrid portfolio and construct a 13.7 MWp project across three cities. Additionally, IFC’s investment includes financing from the Finland-IFC Blended Finance for Climate Program.

With plans to raise an additional $28 million for project finance, Nuru is poised to transform energy access in one of the world’s most challenging environments while driving sustainable development.

15. Victory Farms

Country: Kenya

Amount Raised: USD 43M

Funding Rounds: 5

Sector: Agritech

Victory Farms

Victory Farms, founded in 2015 by Joseph Rehmann and his partner, is a pioneering aquaculture company in East Africa, specializing in tilapia farming on Lake Victoria.

The company is vertically integrated, controlling all stages of the supply chain from breeding and feed production to processing and distribution.

Victory Farms aims to address the declining wild fish catch and rising demand for protein in Africa by providing affordable, healthy fish to low-income communities. It operates in Kenya and Rwanda, with plans to expand into Uganda, Tanzania, and Ethiopia.

The company is committed to sustainable practices and has initiated programs like the Graduate Aquaculture for Learning and Training (GALT) to develop local aquaculture expertise.

Victory Farms has raised significant funding to support its growth. In 2023, it secured $35 million for expansion, aiming to increase production to 20,000 tonnes annually in Kenya. Earlier investments include a $4 million mezzanine loan from AgDevCo to support the construction of a feed mill and expansion into Rwanda.

Additionally, Victory Farms received $1 million from Ceniarth in 2019. The company's fundraising success is attributed to its vertically integrated model, which reduces risk and ensures quality control across the supply chain. With its innovative approach and commitment to sustainability, Victory Farms continues to transform the aquaculture industry in Africa while enhancing food security and local economic development.

16. Lumos

Country: Nigeria

Amount Raised: USD 40M

Funding Rounds: 2

Sector: Solar

Lumos

Lumos, founded in 2012 by Nir Marom and Yoni Shiran, is a leading clean energy company revolutionizing access to electricity in Africa.

Headquartered in Lagos, Nigeria, Lumos provides affordable solar home systems through a pay-as-you-go model, enabling households and small businesses to replace expensive and hazardous kerosene generators with modern solar solutions.

Its solar kits include panels, batteries, LED lights, and phone chargers, offering reliable power for daily needs. Lumos has partnered with MTN Group to integrate mobile payments into its services, allowing customers to pay for electricity using airtime credit.

Since launching in Nigeria in 2016, Lumos has installed over 65,000 solar systems, impacting more than 250,000 lives. The company has also expanded operations to Ivory Coast and aims to scale further across West Africa.

Lumos has raised $40 million in funding to date. Notable deals include a $35 million in funding from the Development Finance Corporation (DFC) to expand renewable energy access to over 1 million Nigerians through its off-grid solar home systems installation project in Nigeria.

Despite challenges like currency devaluation and logistical hurdles, Lumos continues to innovate and expand its footprint, delivering clean energy solutions to underserved communities while fostering economic growth across the continent.

17. Sistema.bio

Country: Kenya

Amount Raised: USD 38M

Funding Rounds: 5

Sector: Waste Management

Sistema.bio

Sistema.bio, founded in 2010 by Alexander Eaton and Camilo Pagés, is a global leader in biogas technology, providing modular biodigesters that convert organic waste into renewable energy and biofertilizers.

Headquartered in Nairobi, Kenya, the company operates in 34 countries, including Kenya, Uganda, Tanzania, Ethiopia, Nigeria, Ghana, and Malawi. Sistema.bio’s biodigesters are designed for smallholder farmers, enabling them to produce clean cooking gas and improve agricultural productivity through organic fertilizers.

With over 40,000 biodigesters installed globally, the company has positively impacted more than 100,000 farmers in sub-Saharan Africa while mitigating over 310,000 tons of CO2 emissions. Sistema.bio aims to empower one million farmers by 2025 and reduce 1% of global emissions by 2030.

The company has raised substantial funding to support its expansion. In October 2024, Sistema.bio secured $15 million in funding led by ElectriFI and supported by KawiSafi Ventures and AXA IM Alts to scale operations in Africa and beyond.

Earlier milestones include a $15.6 million Series B round in 2022 and a $3.5 million investment from Novastar Ventures in January 2025 to drive growth across Africa. Partnerships with organizations like Engie Access and Farmerline have further enabled Sistema.bio to expand its reach, introducing biodigesters to Zambia, Mozambique, Ghana, and Nigeria.

18. Africa REN

Country: Senegal

Amount Raised: USD 35M

Funding Rounds: 1

Sector: Solar

Africa REN, founded in 2015, is a pioneering renewable energy company focused on developing, financing, and operating sustainable infrastructure across sub-Saharan Africa.

Headquartered in Paris with offices in Dakar and Ouagadougou, Africa REN has established itself as a leader in West Africa's renewable energy sector.

The company operates notable solar power plants, including the first in West Africa, Senergy 2 (25 MW) in Senegal, and the largest in Burkina Faso, Kodeni Solar (38 MW).

Africa REN also invests in energy storage solutions, such as the Walo Storage project in Senegal, which is the first lithium battery storage unit in West Africa. The company aims to build a portfolio of 250 MW of solar and storage assets by 2026.

Africa REN has secured significant funding to support its projects. Notable investments include a €32m syndicated debt partnerships with the Dutch development bank FMO and the Emerging Africa Infrastructure Fund (EAIF) for the Walo Storage project.

19. Ampersand

Country: Rwanda

Amount Raised: USD 33M

Funding Rounds: 5

Sector: E-mobility

Ampersand

Ampersand, founded in 2017 by Josh Whale, is one of Africa’s first electric mobility companies focused on transforming the continent’s motorcycle taxi industry. Headquartered in Kigali, Rwanda, Ampersand manufactures affordable electric motorcycles and operates a battery-swapping network tailored to local needs.

Its e-motorcycles produce 75% fewer lifecycle greenhouse emissions than petrol bikes and are cheaper to operate, saving riders over $500 annually on fuel and maintenance costs.

Ampersand’s innovative approach includes battery swap stations that allow riders to replace depleted batteries in less time than refueling. The company aims to electrify half of Africa’s motorcycle traffic by 2030, contributing to cleaner air and increased income for riders.

Ampersand has raised $35 million in funding across multiple rounds. Notable deals include a $12 million investment in 2024 and a $3.5 million round in 2021 led by the Ecosystem Integrity Fund, one of the largest e-mobility investment funds in sub-Saharan Africa. Other investors include Acumen, Beyond Capital Ventures, and the European Investment Fund.

These funds have enabled Ampersand to scale operations across East Africa and enhance its technology for cost-effective electric mobility solutions. Recognized as a World Economic Forum Technology Pioneer in 2022, Ampersand continues to lead Africa’s transition to sustainable transportation while improving livelihoods for millions of motorcycle taxi drivers.

20. BasiGo

Country: Kenya

Amount Raised: USD 32M

Funding Rounds: 8

Sector: E-mobility

BasiGo

BasiGo, founded in 2021 by Jit Bhattacharya and Jonathan Green, is a Kenyan e-mobility startup focused on transforming public transportation through electric buses.

Headquartered in Nairobi, BasiGo provides locally assembled electric buses with capacities of 25 and 36 seats, powered by safe battery technology capable of operating all day on a single charge.

The company offers a Pay-As-You-Drive financing model, allowing bus operators to lease or purchase buses affordably while benefiting from free charging and expert maintenance services. BasiGo has partnered with operators like Citi Hoppa and MetroTrans to deploy its buses across Nairobi, serving thousands of passengers daily. In 2023, it expanded operations to Rwanda, introducing electric buses under partnerships with local operators.

BasiGo has raised $35 million in funding to date. Notable rounds include $24 million in Series A funding in January 2025 and $1 million in pre-seed funding in November 2021. Key investors include Climate Capital and Third Derivative.

The funds have supported the scaling of operations, assembly of buses locally via Associated Vehicle Assemblers, and expansion into new markets like Rwanda.