- ClimateOS Africa.

- Posts

- Issue #10. TLDR: Why Cars Are Losing the Electrification Race to Two and Three-Wheelers in East Africa.

Issue #10. TLDR: Why Cars Are Losing the Electrification Race to Two and Three-Wheelers in East Africa.

Electric cars stall on financing, buyer reluctance, and policy holes—issues that haven't slowed Africa's booming e-bodas and buses

🌍 Climate OS: TLDR – Issue 7

"Your comprehensive guide to Africa's climate and mobility revolution – packed with data, insights, and actionable intelligence"

🔥 TODAY'S MUST-READ STORIES

The Great EV Divide: Why cars are losing East Africa's electrification race

Mission 300: How $85B could power 300M Africans by 2030

East Africa's EV Surge: Policy wins fueling an electric revolution

Renewables Reality Check: Who's really leading the clean energy transition?

Spiro's Rwanda Playbook: A blueprint for financing Africa's EV future

🚗 1. THE GREAT EV DIVIDE: WHY CARS ARE LAGGING IN EAST AFRICA'S ELECTRIFICATION RACE.

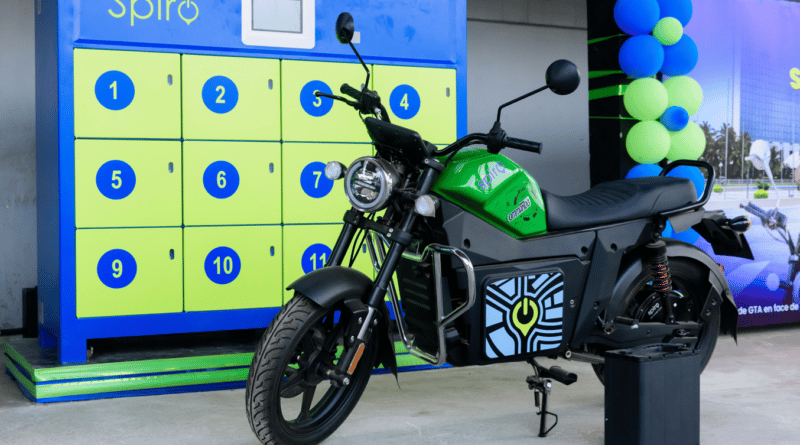

A Spiro Electric Motorcycle.

The Stark Reality

East Africa's EV adoption is following an unconventional path – while electric motorcycles and buses surge ahead, passenger cars remain stuck in neutral. The numbers tell the story:

Uganda: 5,000+ electric motorcycles vs. just 60-80 electric cars

Kenya: 8,200 electric two-wheelers vs. 4,193 electric cars

Tanzania: 3,500 electric bodas vs. fewer than 100 electric cars

Why Two-Wheelers Are Winning

✔ Battery Swap Revolution: Companies like Spiro and Zembo have cracked the affordability code through innovative battery-swapping systems that eliminate charging downtime and reduce upfront costs by 40-50%

✔ Perfect Product-Market Fit: Motorcycle taxis move 80% of urban commuters in Kampala and Dar es Salaam

✔ Policy Tailwinds: Rwanda's petrol bike ban and Kenya's 1,000 charging station plan create ideal conditions

✔ Economic Logic: At $1,300 per unit, e-bodas offer 3x ROI for drivers compared to petrol models

The Car Conundrum

✖ Policy Whiplash: Uganda's 2023 EV tax break lasted just 4 months before reversal

✖ Local Production Catch-22: "Build here" mandates exist where no domestic car manufacturing exists

✖ Used Car Addiction: 80% of Kenya's auto market consists of $8,000 Japanese combustion imports

✖ Financing Desert: No local auto loans for EVs while bodas get pay-as-you-go plans

Buses: The Middle Ground

Kenyan startup BasiGo has 500+ matatu operators on waitlists

Production bottlenecks limit output to just 50 buses/month

"We need African pension funds, not just Silicon Valley VC" – Industry Expert

The Road Ahead

Grid Upgrades: Uganda needs 300MW additional capacity for widespread car charging

Solar's Limits: "Drivers can't wait for sunshine" – AEVA report

Policy Fixes: Kenya's local content rules (15%+ domestic parts) show promise

"The car market will electrify last – but the boda boom proves the model works" – Tom Courtright, AEVA

Read the full story here.

⚡ 2. MISSION 300: THE $85B PLAN TO POWER 300M AFRICANS

The Bold Vision

The World Bank's landmark initiative aims to achieve what decades of traditional grid expansion couldn't:

200,000+ mini-grids (up from just hundreds today)

Priority Countries: DRC (35B plan), Nigeria (35Bplan),Nigeria(27B), Zambia (1,000 villages)

Innovative Financing: Blended capital structures with 50% private sector participation

Transformations in Action

In Zambia's Chitandika village:

School teacher count jumped from 6 to 28 with reliable power

Mechanic Simon Makowani added welding services, boosting income 40%

Grocery owner Damaseke Mwale expanded his business and built a new home

The Challenges

⚠️ Tanzania's 2022 tariff policy reversal forced Husk Power to exit

⚠️ 50% of potential users still can't afford connection fees

⚠️ Trump's aid cuts threaten $30B in pledged funding

Success Factors

Nigeria's 7M new connections through smart regulation

Malawi's electrification rate doubled to 27% since 2023

Pay-as-you-go solar now serving 560M people globally

Read the full story here.

🏍️ 3. EAST AFRICA'S EV POLICY REVOLUTION

Country Spotlights

🇪🇹 Ethiopia

World's first combustion vehicle import ban (2024)

30,000 EVs deployed in 12 months

Addis Ababa's 110 electric buses reducing emissions by 40%

🇷🇼 Rwanda

No new petrol bikes approved in Kigali

Spiro's 30,000 bikes with 20M+ battery swaps

38% emissions cut target by 2030

🇰🇪 Kenya

1,000 charging stations by 2027

Draft e-mobility policy could unlock $500M investment

BasiGo and Roam expanding production

☀️ 4. RENEWABLES: RECORD GROWTH WITH CAVEATS

Renewable Energy.

The Global Clean Energy Paradox

While renewables accounted for 93% of global power expansion in 2024, Africa's share remains disproportionately small despite its vast solar and wind potential. This section breaks down how Chinese dominance and local manufacturing gaps are shaping the continent's clean energy transition, with concrete examples of both challenges and emerging solutions.

The Supply Chain Reality

Solar Panel Economics:

Chinese manufacturers like LONGi now produce panels at 0.18/watt (including shipping to Mombasa), undercutting local African production (0.18/watt(includingshippingtoMombasa),undercuttinglocalAfricanproduction(0.33/watt) by 45%. This price difference stems from:

• 30% lower labor costs in Yunnan province

• 15GW mega-factories achieving unprecedented scale

• $14B in Chinese government production subsidiesBattery Breakthroughs:

CATL's new Moroccan factory (opening Q3 2025) will produce lithium iron phosphate (LFP) batteries specifically designed for African conditions:

• 45°C heat tolerance (vs 35°C for standard models)

• 20% thicker casing to withstand rough roads

• Modular designs allowing 50% local assemblyWind Energy Disparity:

While China installed 75GW of wind power in 2024 alone:

• South Africa added just 487MW (mostly from Danish Vestas turbines)

• Kenya's Lake Turkana wind farm (310MW) remains the continent's only utility-scale project

The Deployment Gap

A detailed comparison of 2024 additions:

Country | Solar Added | Wind Added | Total | % Chinese Tech |

|---|---|---|---|---|

China | 278GW | 75GW | 353GW | 98% |

South Africa | 1.2GW | 0.49GW | 1.69GW | 63% |

Egypt | 2.4GW | 0GW | 2.4GW | 81% |

Rest of Africa | 0.9GW | 0.05GW | 0.95GW | 72% |

Solutions Emerging

Local Manufacturing Push:

The Africa Renewable Energy Manufacturing Initiative (AREMI) has secured $1.2B to build:

• 2GW solar panel plant in Ghana (operational 2026)

• 500MW battery assembly in Kenya

• Blade molding facility in South Africa

Circular Economy Models:

South Africa's Revend recycling plant recovers:

• 92% of lithium from old EV batteries

• 87% of cobalt using hydrometallurgy

• Enough aluminum to make 50,000 new frames/month

Hybrid Financing:

The "Solar+Storage" initiative blends:

• 40% concessional loans (2% interest)

• 30% carbon credit pre-purchases

• 20% manufacturer rebates

• 10% community equity

Enjoy the full report here.

💰 5. SPIRO & EQUITY BANK: FINANCING RWANDA'S EV

The Ecosystem Play

Spiro's partnership with Equity Bank Rwanda represents one of the most comprehensive EV financing model in Africa today, combining vehicle access, energy infrastructure, and financial inclusion into a single scalable system. This deep dive examines the mechanics making it work where others have failed.

The Financial Architecture

Three-Tier Customer Financing:

Option A (Boda Owners):

• 260 down payment (20% of260downpayment(201,300 bike cost)

• 36 monthly installments of $35 at 12% APR

• Includes free maintenance for first yearOption B (Cooperative Groups):

• 10 riders pool resources for bulk discount

• 2,000 down for 10 bikes (2,000downfor10bikes(200/bike)

• Revenue-sharing repayment based on daily earningsOption C (Fleet Operators):

• Lease-to-own model at $0.15/km

• Includes battery swaps and insurance

• Buyback guarantee after 60,000km

Battery Economics Decoded:

Each $600 LFP battery undergoes:1,500 full cycles over 5 years

3,000 partial cycles through smart charging

Revenue streams per battery:0.15/km swap fee (avg. 90km/day) =0.15/km∗∗swapfee(avg.90km/day)=4,050 lifetime

$120 salvage value for recycling

$8/month grid-balancing payments to utilities

Gender Inclusion Mechanisms:

Training Programs:

6-month technician courses for women (45% of graduates)

• Electrical safety certification

• Battery management systems

• Customer service trainingFinancial Products:

• 10% lower interest for women-led cooperatives

• Childcare stipends during training

• Revenue advance during maternity periods

The Ripple Effects

Metric | Impact | Economic Value |

|---|---|---|

Job Creation | 1.2 FTE per bike | 36,000 jobs |

Emission Reduction | 2.3 tons CO2/bike/year | 69,000 tCO2e |

Fuel Savings | $1,800/bike/year | $54M saved |

Health Benefits | 12 fewer respiratory cases/1k | $3.2M saved |

Grid Synergy Innovations

Night Charging: Utilizes Rwanda's 80MW excess hydropower capacity at night

V2G Potential: Pilot with 200 bikes providing 4MW grid stability

Solar Integration: 30 swap stations now powered by on-site PV

📊 DATA DEEP DIVE

EV Adoption Per 10,000 People

Copy

Country | E-Bikes | E-Cars | Chargers

----------|---------|--------|---------

Uganda | 1.1 | 0.02 | 0.4

Kenya | 1.5 | 0.8 | 1.2

Tanzania | 0.6 | 0.02 | 0.3 🔌 CALL TO ACTION

How do you think we can improve our newsletter? Talk to us [email protected]

If you enjoyed our newsletter, share it with someone else who will love it too. Click here.

If you want to support the work that we do, send me an email [email protected]. We are looking for grants that can help us to continue and improve our coverage of climate change and climate action in Africa.

"The revolution will not be uniform – but it will be electric" ⚡