- ClimateOS Africa.

- Posts

- Issue #15. Africa's 50 Most Funded Climate-Tech Startups. Part IV (31-40).

Issue #15. Africa's 50 Most Funded Climate-Tech Startups. Part IV (31-40).

African climate-tech startups raised $3bn from 2019-2024. We profiled 50 of them.

Cover Photo

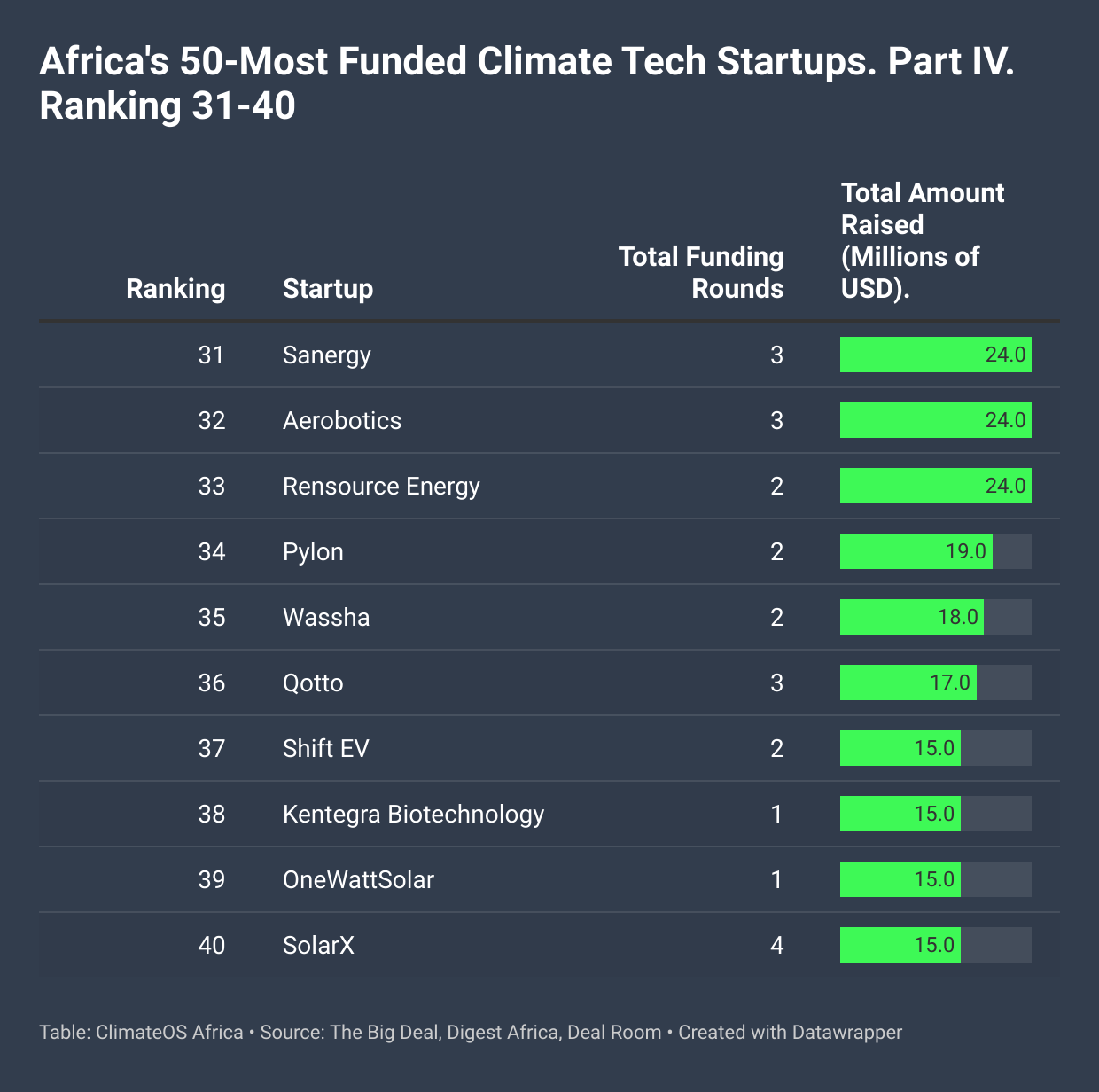

Welcome to part IV of Africa’s Most Funded Climate-tech Startups. If you are reading this and didn't read part I, part II or part III, you can find them here for part I, part II and part III. Highly recommend reading them before you read Part IV to get proper context. In part IV, we are profiling startups ranked 31-40 on our list. Here is a summary of the startups that we are profiling today.

Africa’s Most Funded Climate-Tech Startups. Part IV. 31-40.

Let’s dive into the profiles of these startups.

31. Sanergy

Country: Kenya

Amount Raised: USD 24M

Funding Rounds: 3

Sector: Waste Management

Sanergy

Sanergy is a pioneering social venture based in Nairobi, Kenya, that addresses the sanitation crisis in urban informal settlements by providing affordable and hygienic sanitation solutions.

Founded in 2010, Sanergy operates through a circular business model that includes building and franchising low-cost toilets, collecting waste, and converting it into valuable products like organic fertilizer and insect-based animal feed.

The company serves over 310,000 residents daily and processes around 50,000 tons of waste annually, making it the largest waste recycling factory in Eastern Central Africa.

Sanergy's operations are structured under the Sanergy Collaborative, which includes three independent companies: Fresh Life (sanitation services), Regen Organics (waste conversion), and Citywise Consulting (sanitation advisory services).

The company has received significant recognition, including being named one of the most innovative companies by Fast Company. Sanergy completed a successful Series C funding round in 2022 to scale its operations and expand globally.

Its innovations have helped boost farming yields by up to 30% for over 5,000 farmers, contributing to food security and sustainable agriculture practices.

32. Aerobotics

Country: South Africa

Amount Raised: USD 24M

Funding Rounds: 3

Sector: Agritech

Aerobotics

Aerobotics, founded in 2014 by James Paterson and Benji Meltzer, is a South African agritech startup leveraging artificial intelligence, drone technology, and satellite imagery to enable precision farming.

The company focuses on providing tree and fruit farmers with actionable insights to monitor crop health, track pests and diseases, and optimize yields.

Aerobotics’ flagship platform, Aeroview, combines AI-powered analytics with high-resolution imagery to help farmers make data-driven decisions. Its solutions contribute to climate-smart agriculture by reducing water usage, minimizing farm inputs, and improving productivity per hectare.

Aerobotics has raised significant funding to scale its operations. In 2021, it secured $17 million in a Series B round led by Naspers Foundry, with participation from Cathay AfricInvest Innovation and FMO Ventures. Earlier rounds included $4 million in Series A funding in 2019.

The funds have supported the company’s global expansion into markets like the U.S., Australia, and Europe while enhancing its technology for yield prediction and orchard management.

Aerobotics operates in over 18 countries and has become a critical player in addressing food security challenges exacerbated by climate change. By empowering farmers with advanced tools, Aerobotics is transforming agriculture while promoting sustainable practices worldwide.

33. Rensource Energy

Country: Nigeria

Amount Raised: USD 24M

Funding Rounds: 2

Sector: Solar

Rensource Energy

Rensource Energy, founded in 2015, is a leading West African provider of renewable energy services, specializing in solar-hybrid captive power solutions for commercial, industrial, and utility customers.

The company offers a unique "Power-as-a-Service" (PaaS) model, allowing businesses to sell electricity to their customers through small solar-hybrid systems installed on-site.

Rensource operates primarily in Nigeria, providing clean, reliable, and affordable energy to SME clusters and large enterprises. Its mission is to improve productivity in sub-Saharan Africa's leading businesses by solarizing them with an engineering-first approach.

Rensource has achieved significant milestones, including the launch of its first micro-utility project at the Sabon Gari Market in Kano State, Nigeria, with financial backing from NEoT Offgrid Africa. The company aims to deploy multiple micro-utility projects across Nigeria, targeting over 200,000 end-users by expanding its operations.

Rensource has raised a total of approximately $24 million in funding. In 2019, it secured $20 million to electrify 20 local markets in Nigeria. The company's financial model includes an internal "bank" that finances solar-hybrid systems and manages monthly collections from customers. Rensource's innovative approach has positioned it as a key player in addressing Nigeria's power crisis while promoting sustainable energy solutions across West Africa.

34. Pylon

Country: Egypt

Amount Raised: USD 19M

Funding Rounds: 2

Sector: Waste and Water Management

Pylon, founded in 2017 by Ahmed Ashour and Omar Mohamed Radi, is an Egyptian climate-tech startup specializing in smart infrastructure management for water and electricity distribution companies in emerging markets.

The company offers a subscription-based "Smart Metering as a Service" (SMaaS) platform that helps utilities improve revenue collection by up to 40%, reduce operational inefficiencies, and achieve a more efficient environmental footprint.

Pylon's technology is adaptive to both old and new metering systems, allowing utilities to capture up to $400 billion in losses and uncollected revenue without incurring upfront costs.

Pylon has expanded its operations across Egypt and the Philippines, working with multiple utility companies. Notable clients include Mostakbal City, Egypt's first green smart city, and the Ministry of Defense in Egypt. In the Philippines, Pylon collaborates with the City of Iloilo and other clients.

In 2022, Pylon raised $19 million in a seed funding round led by Endure Capital, with participation from Y Combinator, Cathexis Ventures, Khawarizmi Ventures, LoftyInc Capital Management, and various angel investors.

This funding supports Pylon's expansion into new markets and enhances its product development. Pylon aims to reduce CO2 emissions by 1 gigaton by 2035 and conserve water resources, contributing to a more sustainable future in emerging markets.

35. Wassha

Country: Tanzania

Amount Raised: USD 18M

Funding Rounds: 2

Sectors: Solar

Wassha

WASSHA Inc., founded in 2013 by Satoshi Akita, is a climate-tech company providing affordable, solar-powered electricity solutions to underserved communities in Africa.

The company operates through a kiosk-based model, offering rental services for LED lanterns and other devices powered by solar energy. WASSHA enables small businesses and households in off-grid areas to access clean energy without upfront costs, improving livelihoods by extending operating hours and reducing reliance on kerosene.

The company currently operates in five African countries, including Tanzania, Uganda, Mozambique, Nigeria, and the Democratic Republic of Congo, with over 6,000 kiosks serving 1 million people.

WASSHA has received notable funding to scale its operations. In June 2022, Dai-ichi Life Insurance Company invested JPY 300 million (~$2.2 million) as part of its ESG impact investment strategy.

Earlier funding includes support from UTEC (University of Tokyo Edge Capital Partners), which has been a lead investor since WASSHA's inception. These investments have allowed the company to expand its kiosk network and enhance its IoT-based remote monitoring systems for efficient service delivery.

With its mission to "ignite" possibilities for underprivileged communities, WASSHA continues to drive sustainable development by providing clean energy access while addressing social and economic challenges in off-grid regions.

36. Qotto

Country: Burkina Faso

Amount Raised: USD 17M

Funding Rounds: 3

Sector: Solar

Qotto

Qotto, founded in 2016 by Jean-Baptiste Lenoir and François de Maupeou, is a climate-tech startup providing solar-powered energy solutions to off-grid households in West Africa.

The company operates in Burkina Faso, Benin, and recently expanded to Ivory Coast, offering standalone solar kits through a pay-as-you-go model. Qotto’s products include solar panels, batteries, lamps, USB charging ports, and even TV kits, designed to improve access to electricity for communities with limited infrastructure.

In addition to energy solutions, Qotto is diversifying its offerings by introducing financial services like micro-insurance and micro-credit, as well as internet access hotspots in high-traffic areas.

Qotto has raised $17.18 million in funding to date. In February 2023, it secured $8 million in a Series A equity-debt round led by the IBL Group, with participation from the Off-Grid Energy Access Fund (FEI-OGEF), Cordaid, and existing investors.

This funding supported its expansion into new markets like Ivory Coast and East Africa while enhancing its product lineup and service delivery. Qotto reported a 50% year-on-year revenue growth and had 11,000 active customers by the end of 2022, with plans to double this number following its growth strategy.

With its innovative approach to essential services and alignment with Sustainable Development Goals (SDGs), Qotto is addressing critical issues such as energy access, connectivity, and financial inclusion for underserved communities in sub-Saharan Africa.

37. Shift EV

Country: Egypt

Amount Raised: USD 15M

Funding Rounds: 2

Sector: E-mobility

Shift EV

Shift EV, founded in 2020 by Aly El Tayeb and Amr Helmy, is an Egyptian electric mobility startup pioneering the conversion of existing fuel-run vehicles into electric ones using its in-house designed and manufactured batteries.

Headquartered in Cairo, Shift EV aims to accelerate the transition to electric vehicles (EVs) in emerging markets, focusing on commercial fleets such as logistics and delivery companies.

The company's solutions offer significant environmental benefits by reducing carbon emissions and operational costs by up to 70% compared to traditional internal combustion engine vehicles.

Shift EV has raised an undisclosed Series A round led by existing investors, including Union Square Ventures, Algebra Ventures, and Wamda, with new participation from the Oman Technology Fund (OTF).

This funding supports its expansion across the Middle East and North Africa (MENA) region. The company has a pipeline of 2,000 vehicles to convert and is developing real-time sensor data connectivity systems to enhance vehicle performance monitoring.

Shift EV's innovative approach to fleet electrification includes a modular battery design that can be customized for various vehicle types, making it a cost-effective solution for businesses transitioning to electric mobility. The company is expanding its operations beyond Egypt, including a recent entry into the Spanish market, further solidifying its position as a leader in the electric vehicle conversion sector.

38. Kentegra Biotechnology

Country: Kenya

Amount Raised: USD 15M

Funding Rounds: 1

Sector: Agritech

Kentegra Biotechnology Holdings LLC, founded in 2017, is a US-Kenyan biotech company specializing in the production of organic insecticides from pyrethrum flowers.

Headquartered in Nairobi, Kenya, Kentegra collaborates with smallholder farmers to cultivate and process pyrethrum, producing Pale Refined Extract (PRE), a key ingredient in natural pesticides and insecticides.

The company's mission is to drive sustainable human flourishing by empowering farmers through timely payments, high-quality seeds, and regenerative farming practices, which increase farmers' incomes significantly compared to traditional crops.

Kentegra has raised funding to support its growth. In June 2024, Finnfund invested $500,000 as part of a $3 million project financing package, with Finnfund's share being 17%. Kentegra is currently seeking over $1 million in capital, with a split of 10% equity and 90% debt. The company's operations have a positive impact on smallholder farmers, providing them with a steady income and contributing to climate change adaptation through climate-smart farming practices.

Kentegra operates with a strong focus on sustainability and social impact, employing over 130 people and working with farmer communities across Kenya. Its products cater to the global demand for natural pest control solutions, aligning with the trend away from synthetic pesticides.

39. OneWattSolar

Country: Nigeria

Amount Raised: USD 15M

Funding Rounds: 1

Sector: Solar

OneWattSolar, founded in 2018 and headquartered in Lagos, Nigeria, is a FinTech-driven renewable energy company revolutionizing electricity access across Africa.

The company operates an innovative Energy-as-a-Service (EaaS) model, providing solar rooftop systems to households, small businesses, and institutions with zero upfront costs. Customers pay for the electricity consumed through a blockchain-powered payment system using tokens called "green coins."

By integrating advanced technologies like blockchain, AI, IoT, and big data, OneWattSolar ensures transparency, efficiency, and real-time monitoring of energy usage. This approach is designed to address Africa's energy poverty by offering affordable and sustainable off-grid solutions.

OneWattSolar has raised significant funding to scale its operations. These include a ₦2 billion ($4.9 million) Green Bond and a ₦1 billion ($2.4 million) Green Sukuk. These funds have enabled the rollout of flagship products like CHI OMA (IoT-enabled digital assets) and AMINA (AI-powered software).

Earlier in its journey, OneWattSolar secured $7.3 million in debt financing to expand its reach. The company aims to deploy 14,000 megawatts of renewable energy across sub-Saharan Africa by 2030, with a vision of becoming the continent's leading platform for clean energy access.

40. SolarX

Country: Mali

Amount Raised: USD 15M

Funding Rounds: 4

Sector: Solar

SolarX

SolarX, founded in 2020, is a renewable energy startup based in Bamako, Mali, specializing in solar energy solutions for the commercial and industrial (C&I) sectors.

The company provides a comprehensive range of services, including feasibility studies, installation, commissioning, operations and maintenance, and project financing.

SolarX aims to address challenges such as low electrification rates and high energy costs in Africa by offering tailored solar solutions that optimize energy consumption and reduce carbon footprints. The company promotes sustainable development and energy security while driving low-carbon economic growth.

SolarX has raised $15 million in funding to date. Its latest funding round included $8 million in a line of credit secured in 2024, with investors such as the African Development Bank Group, FMO, and E3 Capital. This funding supports SolarX's expansion and enhances its ability to provide high-value-added services to clients across West Africa.

With a team of international and local engineers, SolarX is committed to delivering innovative and customized renewable energy solutions that adhere to international standards. By focusing on the C&I sector, SolarX is playing a crucial role in advancing clean energy adoption and fostering sustainable economic growth in Africa.